Industry Pulse Check: The Future of Digital in Pharma According to Industry Leaders

We asked a sample of industry leaders to give their views on pharma’s use of digital tools and what the future holds. Here is what they told us

- Survey respondents believe there is a big variation between companies when it comes to innovation in the field of digital health, with the industry as a whole scoring poorly

- Despite seeing the potential of digital health to support patient outcomes, the majority of respondents believe an unclear return on investment is holding pharma back

- However, actionable insights from anonymous patient data and patient education/activation campaigns can drive the business case for greater investment in digital tools

For our first Industry Pulse Check, we reached out to leaders within the pharmaceutical industry and asked them to complete a short survey about the use of digital health tools. Read on to find out which companies are considered the most (and least innovative) and why making the business case for digital health is crucial for unlocking its potential.

Innovation Greatly Varies Between Pharma Companies

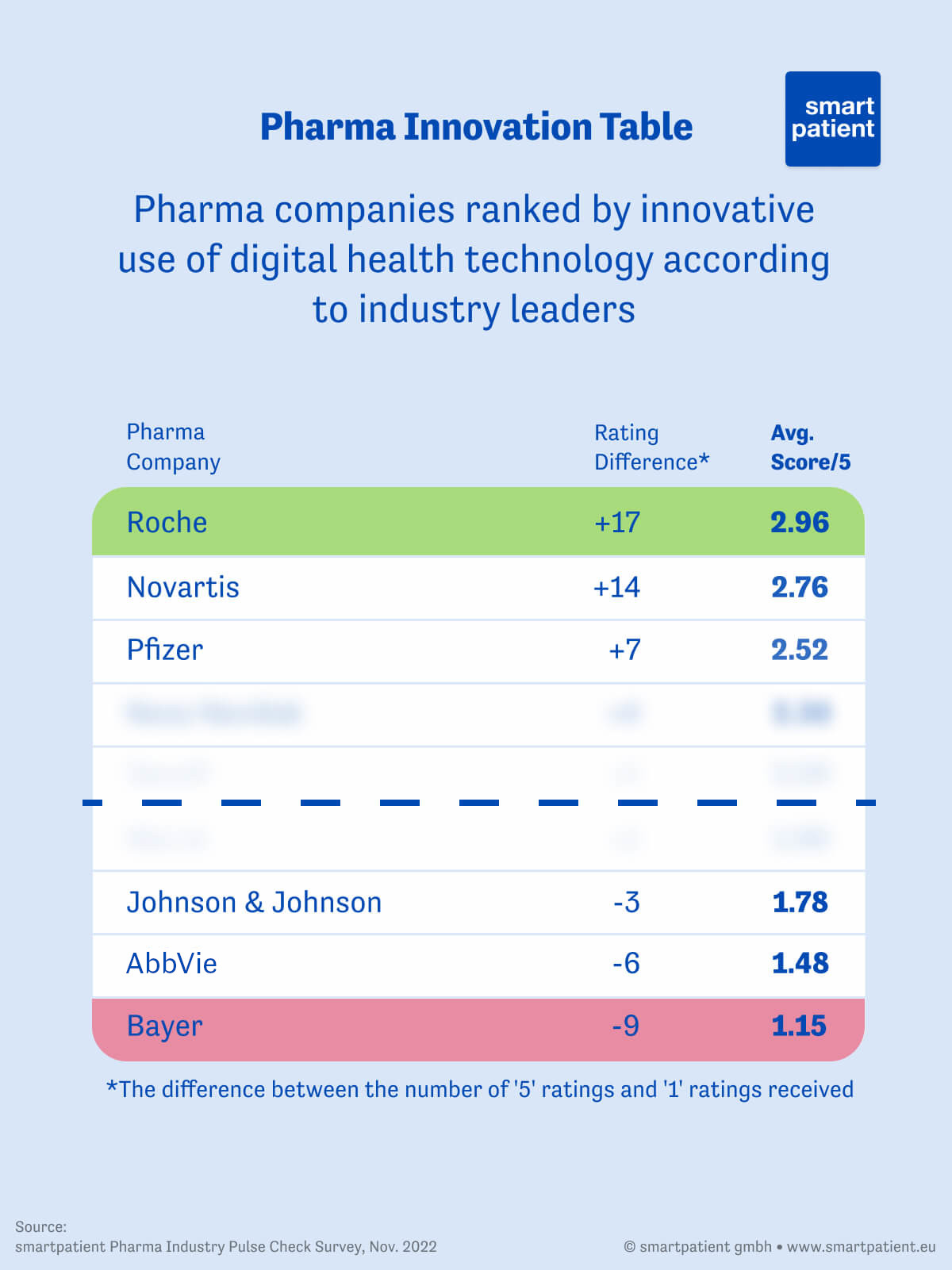

We asked respondents to rate 25 of the largest pharma companies out of 5 for their innovative use of digital health tools (5 being very innovative). Of the companies to receive at least 20 votes, Roche came out as the clear winners with a score of 2.96, having received the top mark from nearly half of respondents to have given them a score. Novartis came in second place with 2.76, with Pfizer making up the top 3.

At the other end of the scale, Bayer came in last place with an average score of 1.15 without receiving a single 5/5 rating. AbbVie fared a little better with an average of 1.48, while Johnson & Johnson scored 1.78. Sanofi, Merck, and Novo Nordisk made up the middle of the pack.

Of the 409 votes cast in total, the average score was 2.05, suggesting that respondents don’t consider the industry’s use of digital tools to be particularly innovative.

This perceived lack of innovation within the pharma industry exists despite respondents' apparent enthusiasm about the potential of digital tools to deliver greater patient support, particularly when it came to adherence and persistence support and helping patients learn how to use new treatments, such as self-injection devices.

So, why is pharma’s use of patient-facing digital tools lacking when it comes to innovation?

Unclear Return on Investment is Stifling Pharma’s Use of Digital

We asked respondents what they believed the biggest roadblocks are for pharma advancing its digital capabilities in the coming year. Roughly two-thirds of respondents said that an unclear return on investment stifles pharma’s digital use.

Nearly as many believe that a lack of acceptance among healthcare professionals is a restricting factor, while almost half replied that pharma fails to reach patients at scale.

Other roadblocks specified in the comments section include the need for greater evidence demonstrating the value of digital tools, difficulties with pharma’s internal processes concerns, and a lack of internal awareness and understanding of digital tools.

A topic that was mentioned multiple times in the comments was that of compliance, with several respondents saying that regulatory requirements are a “concern” for pharma.

Evidently, industry leaders still see a variety of factors holding pharma back from advancing its digital capabilities, which goes some way to explaining the perceived lack of innovation taking place in the field. Chief among those roadblocks is an unclear return on investment, causing many pharma companies to take an extremely cautious approach to digital and, subsequently, failing to deliver effective patient-facing products.

Actionable Insights from Anonymous Patient Data Make the Business Case for Digital Health

In our discussions with pharma, the stage of a product’s lifecycle that is most important regarding the use of digital is its launch. We have published several articles on this blog discussing the role of digital in pharma’s launch strategy as well as developing DigiSimilars in response to a launch that failed to meet expectations.

We, therefore, asked survey respondents where they see potential value in the use of digital tools when launching new products, as this is arguably the area where the greatest return on investment can be unlocked.

Over two-thirds of respondents voted for treatment initiation support and 63% chose patient education.

Despite being a brand-new concept, the potential of DigiSimilars is considered to be more valuable than drug safety. Additional answers left in the comments included the reporting of side effects and adverse events, and side effects and disease management.

Conclusions from Our Industry Pulse Check

Pharma has long struggled to fulfill the potential of digital tools. The results of our first industry pulse check suggest that despite optimism regarding the use of digital – particularly regarding launches – pharma is still struggling to overcome the same old roadblocks, such as an unclear return on investment and a lack of internal awareness and understanding.

These results reflect many of the discussions we have with existing and potential partners within pharma.

The results strengthen our belief that digital tools have a strong role to play in every stage of a product’s lifecycle. From pre-launch market research, to launch excellence, to patient support and data collection post-launch. The key, however, is for pharma to identify specific purposes for any given digital tool and, subsequently, define KPIs that can help demonstrate a product’s value.

This, in turn, will provide greater insight into the return on investment (or lack thereof) for any given initiative, allowing pharma to commit greater resources to those that have a proven impact.

If you want to discuss the results of our survey in more depth or find out how we build digital tools for pharma on our MyTherapy platform, don’t hesitate to get in touch.