DiGAs 2021: How Reimbursement, Regulation, and Competition Will Shape Germany’s Evolving DTx Market

The first DiGAs have been approved and the first prescriptions have been made. Here are 7 ways we expect DiGA reimbursement to evolve in 2021

- The first DiGAs are on the market and the price points look promising, a reason to expect more to come

- While still young, the market is likely to evolve quickly; toughening regulations, greater competition, and distribution challenges will put economic pressure on players and entrants

- By the end of 2021, we are likely to see fewer “one DiGA” players. Instead, we expect to see professional developers and specialized partners – such as for distribution

This time last year we claimed that 2020 would be the year of digital health app reimbursement. For DiGAs – Germany’s term for prescribable apps – this turned out to be the case. At the time of writing, 10 DiGAs have been approved, price points are emerging, and the market is seemingly dynamic. What does 2021 have in store for DiGAs? In this article, we look at the topic from 7 different perspectives; read on to find out why we believe that the heat is on and why innovators will need to grow-up quickly: The era of the small-teamed DiGA start-up may be over before it has truly begun.

1. DiGA Regulations: Entry Barriers Are Rising

With MDR going live this year following a 12-month delay, almost all DiGAs will classify as at least Class IIa medical devices in Europe. Thereby, an ISO-13485 certified quality management system (QMS) is effectively becoming a pre-requisite. Similarly, an information security management system (ISMS) will be mandatory and rather sooner than later will require ISO-27001 certification.

DiGAV – the German regulation that defines the requirements for the reimbursement of DiGAs – will, like MDR, also bring in additional requirements for privacy and data security.

While these requirements are all doable, meeting them while maintaining the agility and continuous improvement that are stable characteristics of digital healthcare innovators – even with experts on-board – will often mean at least a year of lead time just for having the pre-requisites for product development in place.

2. DiGA Competition: Emerging Battleground (& International Entrants?)

At the International DiGA Summit, held in September 2020, Germany’s Ministry of Health said that the BfArM had already received 25 applications, a number that will surely grow significantly in 2021.

Indeed, the German “Spitezenverband Digitale Gesundheitsversorgung” recently introduced a directory of members targeting registration – highlighting the rising levels of competition.

In 2021, it is reasonable to expect competition to set in for some disease areas. Also we are increasingly seeing experienced health app players entering the DiGA space, and it is fair to expect others (e.g. Kaia for back pain) to follow suit.

3. DiGA Reimbursement: Will Prices Hold Up?

The initial price points for DiGAs are promising. For example, Vivira is listed at €239.97 for 90 days while somnio is listed at €464 for 90 days. Aside from 'Velibra' and 'elevida', all of the DiGAs currently approved are sold based on preliminary price points that need to be backed up by sufficient evidence for improving outcomes within a year of approval. This means that there is still the possibility that the preliminary prices will change, but likely only downwards.

In addition, the expected competition may put pressure on prices. At Frontiers Health, Philip Heimann, CEO of Vivira – the first DiGA for back pain – said: “I think that there’s definitely going to be increased competition in this space – people are moving into this DiGA list – and with the increased competition there’s going to be price pressure. That’s no surprise; eventually, prices will go down.”

As more DiGAs make it to market for certain indications, expect large verticals to move towards generic price points.

4. DiGA Evidence: Win Through Innovation

With most price points being preliminary and competition heating up, the attention is shifting towards evidence. Who can provide evidence of the highest outcome impact and thereby justify high prices?

The need to generate this evidence in a cost-effective and timely manner will drive innovation in clinical evaluation, even more so in an environment of continued social distancing. Players who have access to patients, as well as the methods and tools to perform virtual clinical trials are best positioned to lead the way.

5. DiGA Development: The Rise of ‘DiGA Factories’

Considering the cost of overcoming the barriers to entry and building the know-how and infrastructure, it is questionable whether a single DiGA is enough to develop a positive business case around.

We expect players trying to establish themselves as ‘DiGA factories’, generating economies of scale by applying their processes and technical infrastructure to multiple indications. This was a viewpoint again supported by Vivira’s Philip Heimann at Frontiers Health: “That is why right now is the perfect time to do a funding round, to leverage that and to build a factory that quickly churns DiGAs out, in our specific area, that has tons of niches that we can move into."

6. DiGA Distribution: Innovative Partnership Models

As of mid-November 2020, Techniker Krankasse – Germany’s largest insurer that represents over 10% of the publicly-insured population – was aware of 112 DiGA prescriptions.

Once the excitement over DiGAs levels off, manufacturers will realize that, like any innovative medicines, even the best DiGA requires a sound distribution model that will help drive prescriptions.

We expect new types of partnerships to arise; as in pharma, specialized distribution partners will approach doctors on behalf of DiGA players. Additionally, partnering with pharma directly and having them add DiGAs to their sales portfolio may well emerge as a trend in 2021, as the recently announced partnership between Chiesi and Kaia suggests.

7. DiGA International: A Role Model for Europe and a Magnet for Global Players?

In a blog post published in December, we looked at the possibility for DiGAs being a potential blueprint for other European countries.

Beyond Europe, eyes around the world are on Germany. No matter which international player you ask, all are keeping a close eye on DiGAs and how the regulatory landscape evolves. In his keynote speech at Frontiers Health, Propeller Health CEO, David Van Sickle, hinted that the US-based company will pay close attention to the development of DiGAs as it looks to grow its presence in Europe: “The regulation is still a little unstable and so we’re trying to make sure that how we develop for that market and how we enter the DiGA process is as efficient and as directed as possible.”

With the US being at the forefront of digital health development, Propeller is likely among a host of innovators that may consider Germany to be the most logical and attractive entry point into the European marketplace.

DiGA 2021: What Does it Mean for You?

With Germany among the world leaders for digital health app reimbursement – and with 73 million publicly insured people – the evolution of DiGAs in 2021 will be a key indicator of how the prescribable health app and digital therapeutics markets are likely to develop.

Cracking the DiGA market will likely act as a springboard for digital health innovators that have global ambitions. As we discussed in a previous blog post – Germany’s Fast-Track to Health App Reimbursement: 5 Hurdles You Should Know About – doing so is not an easy feat.

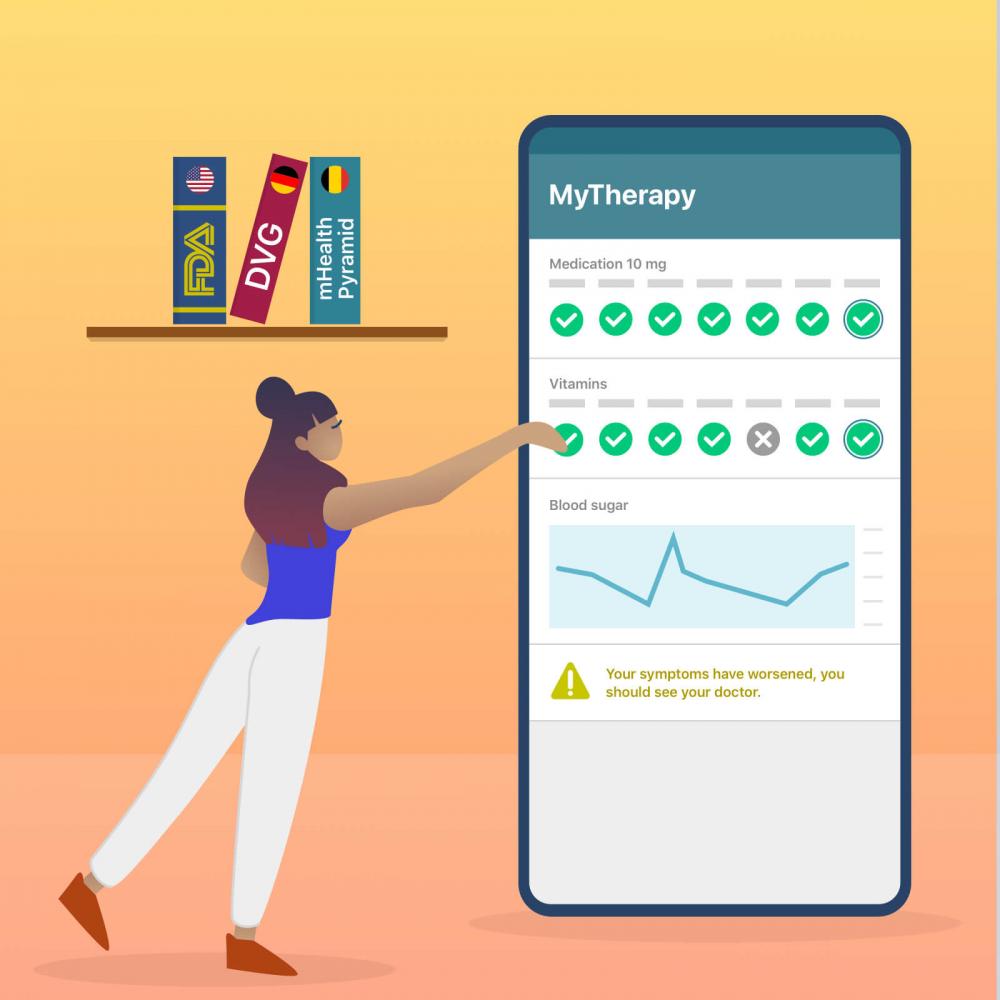

At smartpatient, we implement DiGAs and DTx using MyTherapy, a disease management app with millions of users and global regulatory compliance. Having the technology and the processes in place, we enable partners to quickly launch digital therapeutics while adhering to various local market requirements. Sounds interesting? Don't hesitate to get in touch.